Table of Content

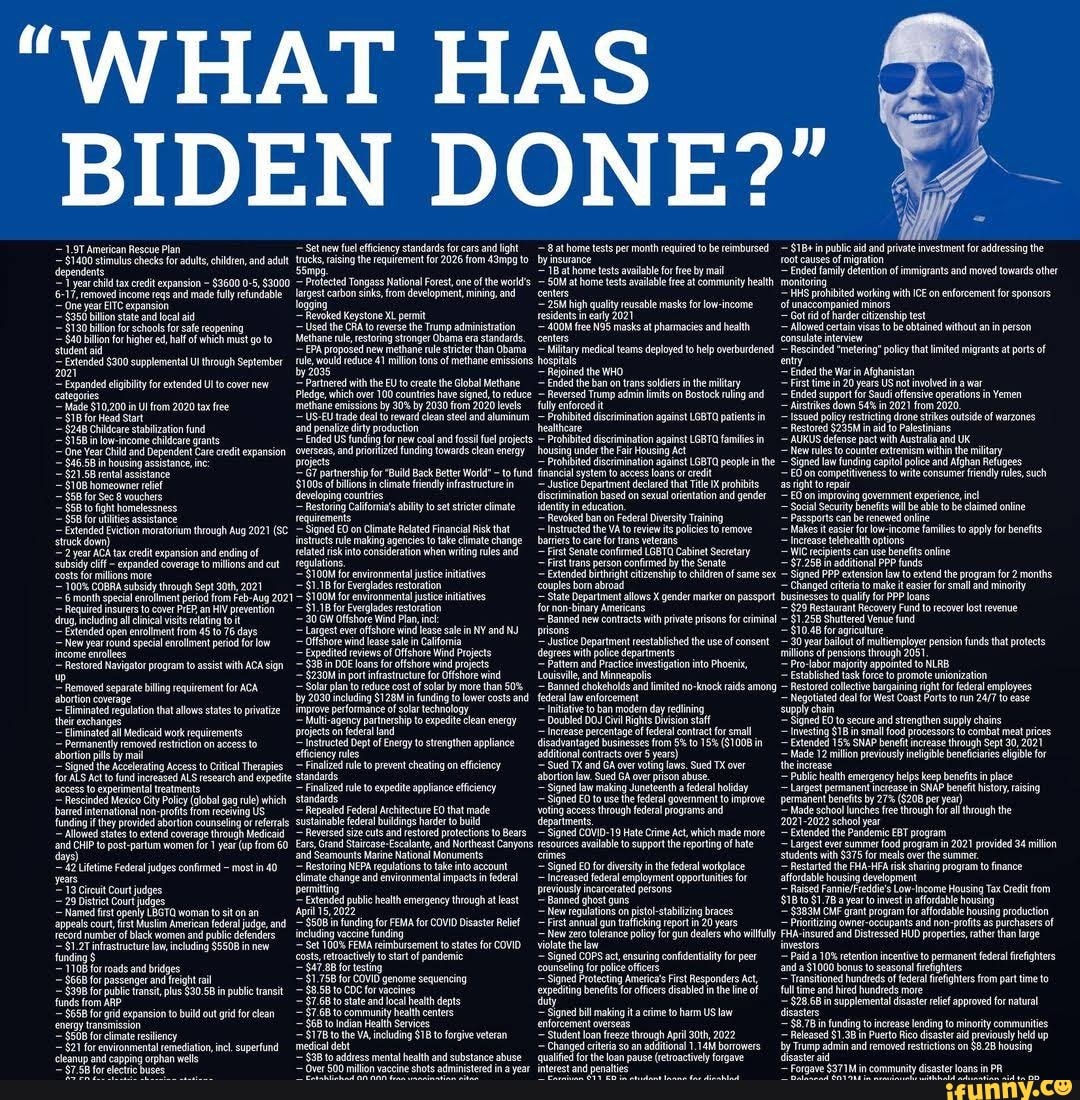

If you work in California, it’s essential to know the new labor laws that went into effect on January 1, 2022, especially those that pertain to working from home. Therefore, Dan is an exempt employee, and the school he works for does not have to pay him overtime. If an exempt employee does any work in a week, the employee must be paid.

As such, if the employee is working additional hours on the seventh day over the forty hour workweek, they must receive overtime pay. An exempt employee is an employee who is considered to be exempt or excused from overtime pay requirements. The Fair Labor Standards Act (“FLSA”) sets the guidelines for overtime pay requirements. Generally speaking, when an employer permits or requires an employee to work overtime, they are obligated to pay the employee for their overtime work. Employees who fall under the FLSA must receive overtime pay for hours worked in excess of forty hours.

Do salaried employees get paid if they do not work?

Most employees, including exempt employees, are entitled to an unpaid, 30-minute lunch break if they work more than 5 hours a day. If an employee works 10 or more hours in a day, they are allowed to have another meal break. To satisfy the minimum salary requirement, employers must pay employees on a salary basis rather than an hourly basis. A full-time employee must also receive a salary that is at least twice the California minimum wage. The main con against nonexempt employees working at home is the requirement that the employer pay them for all time worked.

As 2022 begins, all employees must understand their rights and how the most recent employment laws affect their employment. Double the employee's regular rate of pay for work in excess of 12 hours per day and any work in excess of eight on those days worked beyond the regularly scheduled number of workdays established by the agreement. The magazine requires people in Tessa’s position to sell at least 100 ads per year.

Important Labor Law Information

And if an employer plans to monitor employees’ use of its equipment, that should be clearly communicated, he added. One key takeaway for all timekeeping policies is that employees must be paid for all hours worked, even if they worked those hours in violation of the policy. For example, if an employee works overtime without authorization, the employee can be disciplined for violating a policy requiring authorization, but must nevertheless be paid for those overtime hours at the applicable overtime rate.

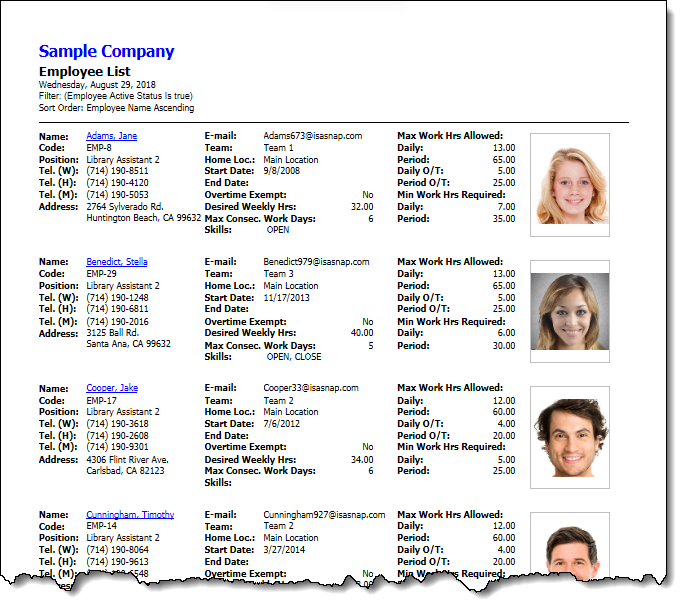

This section discusses the exempt and nonexempt classifications with reference to California standards for minimum salary and job responsibilities. Such an arrangement must be pursuant to an agreement or understanding arrived at between the employer and employee. Double time is required after 12 in a workday (Labor Code § 510). Weekly overtime required after 54 hours or more than six days in a workweek. In an emergency, employee may work over 54 hours or more than six days in a workweek and must be paid not less than one and one-half times employee's regular rate of pay for all such excess hours. Order 5 Personal attendants employed by a non-profit organization No daily overtime.

What are the rules for exempt employees in California?

Your employer can request that you take a break at this time. Most employment contracts in the United States are at- will, meaning that both the employer and employee can end their relationship at any time. While every law is different, in many instances, intranet postings and/or email circulation of the notices will suffice to meet an employer's obligations. Employers should confirm the specific requirements for their applicable jurisdictions and determine a compliant manner to "post" or disseminate such notices. We've helped more than 5 million clients find the right lawyer – for free.

Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. Finally, employers need to be aware of potential tax implications of employees working out of state. Employers should be aware of this potential issue and consult tax professionals for specific guidance.

What are my rights as a salaried employee in California?

Still, employers are warned not to discourage accurately reporting time, and employees can’t waive their right to compensation under the FLSA. There should be at least 11 consecutive hours of rest for a 24 hour period. Workers are entitled to at least 11 hours of rest per day, at least one day off each week, and a rest break if they work more than six hours. Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day.

In addition, we have local employment law offices in and around Los Angeles, San Diego, Orange County, Riverside, San Bernardino, Ventura, San Jose, Oakland, the San Francisco Bay area, and several nearby cities. So to be exempt, employees earning commission must earn more than $22.50 per hour or $21.00 per hour . Making immigration-related threats against employees who exercise their rights under these laws is unlawful retaliation.

There are some exceptions to the overtime pay requirements in California. Exemptions exist for specific categories of employers, as well as specific categories of workers. Employees who work overtime without the authorization of their employer must still be paid overtime pay, so long as the employer knows about the hours. However, if the employee conceals the overtime work in an attempt to deceive the employer and receive the additional pay, the employee will not be entitled to the pay. Again, state laws vary in terms of how they address exempt and nonexempt employees. An individual state will likely have its own definition of what constitutes overtime.

The California Equal Pay Act prohibits employers from paying a lower salary to an employee of the other sex than to an employee of the same sex. Alternatively, many employees prefer to be in nonexempt positions, as they are paid for every hour they work. In general, such employees are only required to work the assigned number of hours. However, most nonexempt employees are held to stricter standards for casual time. An example of this would be how nonexempt employees tend to be monitored more closely regarding their breaks. When all three requirements are met, a California employee will be considered exempt from overtime pay requirements, as well as minimum wage and rest break requirements.

Determine whether current time-tracking systems can be accessed remotely. “How will I know whether these employees are really working? Hughes said that when she suggests an organization consider allowing telework for certain nonexempt positions, she often gets pushback. Learn how SHRM Certification can accelerate your career growth by earning a SHRM-CP or SHRM-SCP. The bulletin from the DOL’s WHD also includes references to court cases affirming the guidance regarding working from home, reporting hours, procedures and how they comply with the FLSA.

Exempt employees are not entitled to protections under overtime laws or wage and hour laws. Nonexempt employees are entitled to those protections under the Labor Code. This requires payment of time and one-half for any work performed on any day not included in the schedule established by the agreement. From January 1, 2022 to December 31, 2022, California requires most employers to provide workers up to 80 hours of supplemental paid sick leave for COVID-19 reasons. If a worker took unpaid time off due to COVID-19 in 2022, they should be paid for these sick leave hours. More information is available in the Labor Commissioner's frequently asked questions.

How many hours can a salaried exempt employee be forced to work in California?

During lunch breaks, employees are free to leave the premises and must be relieved of all work responsibilities. To qualify as a California exempt employee, the employee must be able to exercise independent judgment in their role. An individual is considered an administrative employee if their job function relates to management or business operations.

No comments:

Post a Comment