Table of Content

- Exempt vs. Non-Exempt Employees in California

- How many hours can a salaried exempt employee be forced to work in California?

- Can I be paid less than my contracted hours?

- The Executive, Administrative and Professional Employee Exemption

- What are my rights as an employee in California?

- What is the minimum salary for exempt employees in California 2020?

- What Else Should I Know About Exempt and NonExempt Employees in California?

- Can my employer force me to work overtime?

It’s important to keep your employees up to date on the process. DLSE’s enforcement policy does not permit a reduction in the salary of an exempt employee which is the result of a reduction in the number of hours worked in a day. Salaried employees are not allowed to have their pay deducted by their employer if they work less than 40 hours per week or if they work more than 40 hours per week. When all employees work in a single location, the employer knows they are covered by the laws of that state and locality.

Yes, if an employee does not qualify to use paid sick leave, or has exhausted sick leave, other leave may be available. If there is a vacation or paid time off policy, an employee may choose to take such leave and be compensated provided that the terms of the vacation or paid time off policy allows for leave in this circumstance. California Labor Code Section 2802 requires employers to reimburse employees for "all necessary business expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties." Lastly, employers should ensure hourly workers are only doing the work they want to be completed. If an employee does work the employer did not want and had no reason to know about, the employer may not have to pay for those hours.

Exempt vs. Non-Exempt Employees in California

Employers must reimburse employees for any business expenses that they incur. This might include unforeseen costs with extra computer expenses and WiFi equipment. Regularly and customarily exercise discretion and independent judgment at work.

There are other considerations to take into account when working as a remote employee in California. Because options for scheduling can be so varied, making sure you get proper payment for time is crucial. If the company you work for is based in another state, you may need to be aware of those laws, as well as employment laws that vary among states. Employees have the right to waive overtime pay if they choose to go on a flex schedule, with alternative workweeks. Though this governing body sets an example for proper remote work practices, not all companies who hire telecommuters do the same. Some will treat employees as freelance contractors but expect workers to clock in like a traditional job.

How many hours can a salaried exempt employee be forced to work in California?

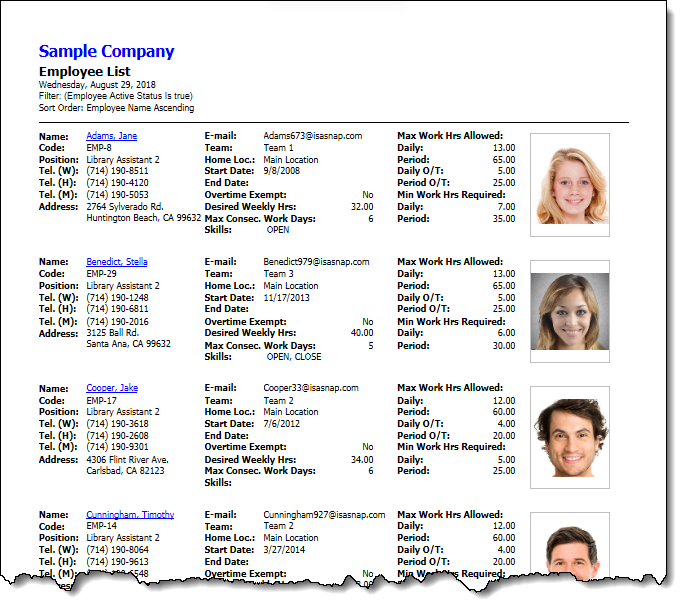

Use this worksheet to help evaluate the exempt versus nonexempt status for your administrative employees. The California Department of Human Resources believes the option to work remotely has great benefits for California State employees, which is why they have encouraged remote work in certain positions. CalHR also feels that the communication between employers and other employees is key to an effective home-work environment. Employees and family members attending vaccination or booster shot appointments qualify for paid sick leave for time spent attending these sessions and recovering from initial side effects. Surgeons and doctors whose primary job duties require them to be licensed. These surgeons and doctors must also earn more than a certain amount, and that amount is subject to change.

The shift to remote work has also benefited many companies and industries that have found more efficient and profitable ways to perform work that was previously done in-person. As employers focus on integrating some degree of remote work into the overall culture of the company, it is important not to lose sight of the potential legal pitfalls that can trap an unsuspecting employer. The same documentation consideration is also true of any harassment, discrimination, or other complaints or investigations that occur with remote employees.

Can I be paid less than my contracted hours?

If, however, the exempt employee does not do any work in the week, the employee’s weekly salary may be reduced. Deductions from salary for absences of less than a full day for personal reasons or for sickness are not permitted. If an exempt employee works any portion of a day, there can be no deduction from salary for a partial day absence for personal or medical reasons.

Judgment is independent when the employee can make decisions on their own without supervision, even if there is a higher-up that may veto this decision. Creative professionals work in fields defined by creativity or invention. Examples of duties relating to management or business operations include accounting, human resources, and marketing. Contacting any attorneys or law firm mentioned on this website, without more, does not create an attorney-client relationship. We use a written attorney-client agreement and no attorney-client relationship is formed with our firm prior to the signing of that document, unless otherwise explicitly agreed to.

The Executive, Administrative and Professional Employee Exemption

There are some exceptions to the overtime pay requirements in California. Exemptions exist for specific categories of employers, as well as specific categories of workers. Employees who work overtime without the authorization of their employer must still be paid overtime pay, so long as the employer knows about the hours. However, if the employee conceals the overtime work in an attempt to deceive the employer and receive the additional pay, the employee will not be entitled to the pay. Again, state laws vary in terms of how they address exempt and nonexempt employees. An individual state will likely have its own definition of what constitutes overtime.

Department of Labor Wage and Hour Division issued a bulletin to remind employers of tracking hours for employees working from home. Only if there is an employment contract and a bargaining agreement. If you don’t have a contract, your employer can legally reduce your work hours and you won’t be able to fight it. “Reasonable overtime may from time to time be required, in accordance with the needs of the business” is a phrase that may be included in your contract. When an exempt employee is absent from work for personal reasons other than sickness or disability, the employer can dock their pay. The last two years have drastically changed the way many people work and their vocational expectations going forward.

I realized gender discrimination was a challenge, however, with your experience and expertise you all took my case head on and never looked back. You fought for me, my rights as a female and after everything was said and done, a. It may not be immediately evident to an employee that they should be classified as non-exempt rather than exempt.

The salary basis requirements for exempt status under California wage and hour law allow employers to require accrued vacation or paid time off for partial day absences without violating them. In order to be considered an exempt employee in the U.S., a worker must be paid at least $684 per week. The state of California requires exempt workers to be paid at least twice the minimum wage. Employees cannot “volunteer” their services to their employer, even if an employee asks to do so! Federal, state, and local laws require employers to compensate non-exempt employees for all time worked and any time an employer suffered or permit an employee to work, whether with or without your approval. Certain computer professionals are exempted from overtime if they are engaged in specific high-level computer-related duties, such as systems analysis or software design.

Managers should be trained to recognize informal remote complaints and must immediately report them to the appropriate individual at the company. All investigations, even if done remotely, must be conducted and documented thoroughly. Wage and hour compliance is fraught with vulnerability, and the issue is, if anything, amplified in a remote work setting. Wage and hour violations are often unintentional but can come with steep penalties, liquidated damages, and even government audits. Wage and hour considerations are particularly important when it comes to non-exempt (i.e., overtime-eligible) employees. California courts narrowly construe the exemptions explained above.

The employee must “plainly and unmistakably” meet the standard required for the exemption.91 Otherwise, the employee should be classified as nonexempt. The rest of this article explains these requirements in greater detail, as well as what happens when employers fail to property classify their employees under California Law. Clark Employment Law, APC, has years of experience representing clients in a wide range of employment law cases in California.

Job titles do not determine a California employee's exempt or nonexempt status. An employee with an impressive job title may not qualify as an exempt employee if his/her actual duties do not meet the requirements for one of the exemptions. Employee shall be paid not less than one and one-half his or her regular rate of pay for any hours worked in excess of 10 in a workday or 48 in a workweek. Employee shall be paid two times his or her regular rate of pay for all hours in excess of 48 in a workweek. An exempt employee must be paid their full salary for any week in which they work, regardless of the number of days or hours worked.